Tax Issues for Dual Citizens

/(minutes taken by Karin Kloosterman, edited by Stephanie Freid, originally posted at http://ciwiseeds.typepad.com/blog/2007/03/phil_stein_at_t.html )

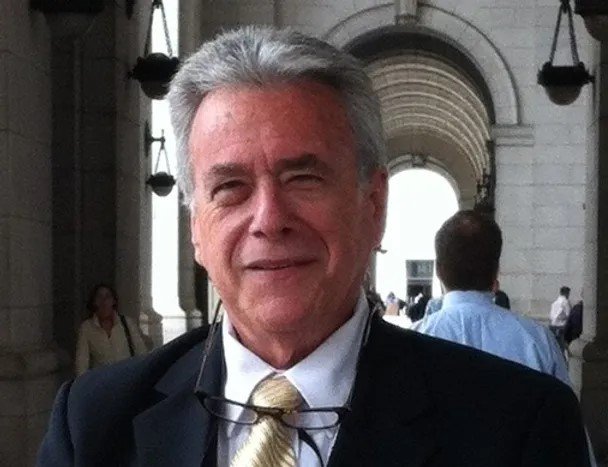

Phil Stein, Accountant, Talks at Tel Aviv Writer's Cafe

Tuesday night US/Israeli tax specialist Phil Stein www.pstein.com came out for café talk in Tel Aviv to give us freelance writers a few tips. Stein came to Israel 28 years ago, and since has started a firm which includes 10 people specializing in US tax, Israeli tax and the points where the two systems meet. He noted that he particularly enjoys working with writers and in the past has given counsel to people whose books have become NY Times bestsellers.

Q: Do I have to file taxes in the US if I file in Israel?

A: Yes. If you have US passport. There was a myth that if you don’t file, they will take your passport. It is not true.

If you make more than $400 per year as an independent you have to file a tax return.

If you are an employee and you are single/married – it all depends. Roughly, you need to earn $8,000 to file a return.

Non-US citizens should ask contractees for a W8BEN form

U.S. citizens should ask for a W-9; if you make more than $600 ask them to send you a 1099 at the end of the year.

If you live here, Israel gets first dibs on taxation i.e. “the biggest bite”. Taxes have decreased here in the last couple of years. But you still have to file in the US.

Q: Do the IRS and mas hachnasa communicate?

A: Yes. The IRS does exchange information with mas hachnasa. I haven’t seen a book, but they are matching the address on your 1099 and can locate you by your address.

Q: If I don’t report taxes to the US over the years what happens to Social Security benefits when I retire?

A: They generally ask to see your last two tax returns. I have seen a lot of people who didn’t file for 20 years and only file the two years before they were about to retire. They took the forms to the Embassy in Israel and I have never seen them denied.

Q: Am I entitled to the per child refundable credit of $1000 that I have been hearing about?

A: Yes if you earn $12,000 or more per year.

Q: Should I let the Israeli side know about my child education or pension fund in the US?

A:Some people are asked to declare assets at a particular date and time. The Israeli government wants to know what you own because they want to compare your assets to your tax returns. I don’t believe child education funds are taxable in Israel.

Q: Is it smarter to open an “independent” file in Israel, or to pay a fee to outsourcing agencies to file on my behalf?

A: The advantage as an American is that it saves you from being an independent and you don’t have to deal with the tax authority; the company takes care of all these tax issues. It is a worthwhile investment but you have to weigh the investment and whether or not you want to filter your pay through an agency.

Q: Do I have to pay mam if I am working with a US company?

A: It depends. You might have to pay if the company is connected to an institution in Israel.

Q: Pension plans?

A: Tax benefits are less than they use to be. You are not stuck having to go to your local bank anymore. There are a lot of independent investment houses and you should shop around. There is a lot of choice out there.

Q: The scenario. You are single with one child and make NIS 15,000 per month. How much tax should I pay?

A: Rates today -- you should take home NIS 11,000 after you have paid bituach leumi, mas briut and mas hachnasa.

Q: Any special deals on taxes as an ola hadasha?

A: If you have stocks, bonds, rental income – you will not be taxed for 5 years.

For more information, please contact Phil Stein.